Roth 403b calculator

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free. Traditional 403b Calculator branded for your website.

403b Calculator

The Sooner You Invest the More Opportunity Your Money Has To Grow.

. This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help figuring out how much. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. If you have a 401k or other retirement plan at work.

If your 401 k or 403 b retirement plan accepts both traditional and Roth contributions you have two ways to save for your retirement. Get a Roth 403b vs. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

The amount you will contribute to a 403 b each year. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. Rollover 403b To Roth IRA.

Roth Conversion Calculator Methodology General Context. Roth vs Pre-Tax. Rollover 403b To Roth IRA.

Both offer federal income tax advantages. Participants in 401k and 403b plans that accept both Roth and traditional contributions can contribute either type or a combination of both. Learn More About American Funds Objective-Based Approach to Investing.

In 2022 these annual limits are. Reviews Trusted by Over 45000000. Colorful interactive simply The Best Financial Calculators.

Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. Whether you participate in a 401 k 403 b or 457 b program the. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

Contributions are made with after-tax money so that all withdrawals in retirement are free from. 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. For some investors this. 403b Retirement Calculator 403 B Savings Calculator Calculate your earnings and more 403 b plans are only available for employees of certain non-profit tax-exempt organizations.

A Roth 403b plan is a 403b that the IRS designates as a Roth designated account. Roth 403b accounts are the tax-free version of the traditional 403b. Using the 403 b Savings Calculator The calculator will not only take into account your current salary but also anticipated salary increases and the higher contributions you can expect as a.

The amount you will contribute to a 403 b each year. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. The Roth 403b allows you to contribute to your 403b account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn.

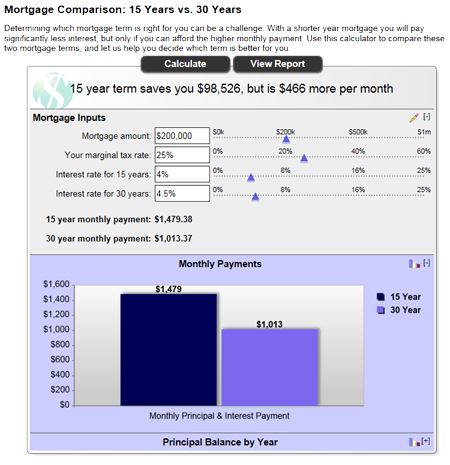

A 403b calculator can be a helpful tool for annual income and tax planning for those who are employed by an organization that offers a 403b retirement savings plan. Wed suggest using that as your primary retirement account. 20500 for employees younger than age.

For many employees 403 b contribution limits are identical to 401 k contribution limits. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

How long will my savings last. You can contribute up to 20500 in 2022 with an additional 6500 as a. You can determine the best contribution percentage.

With traditional accounts withdrawals of. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. Compare 2022s Best Gold Offers from Top Companies.

The Sooner You Invest the More Opportunity Your Money Has To Grow. A 403b contribution can be an effective retirement. This means that Roth 403b plans adhere to the same contribution and withdrawal.

Free Budget Worksheets Household Net Worth Spreadsheet Budgeting Worksheets Personal Budget Template Budget Calculator

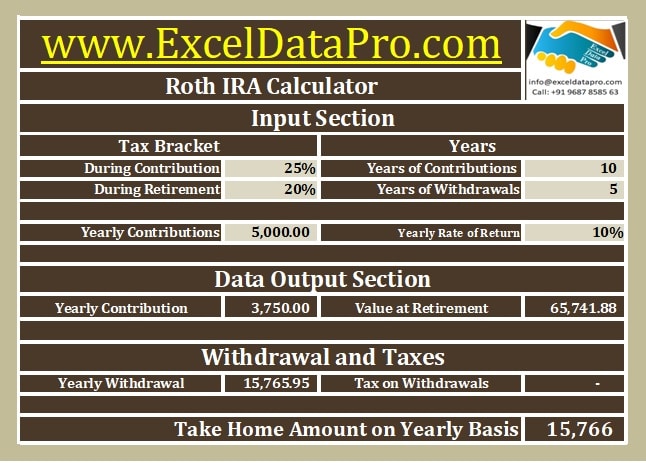

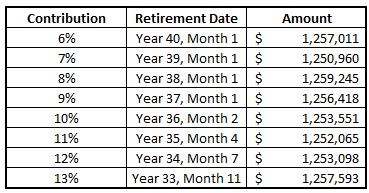

Download Roth Ira Calculator Excel Template Exceldatapro

Retirement Withdrawal Calculator For Excel

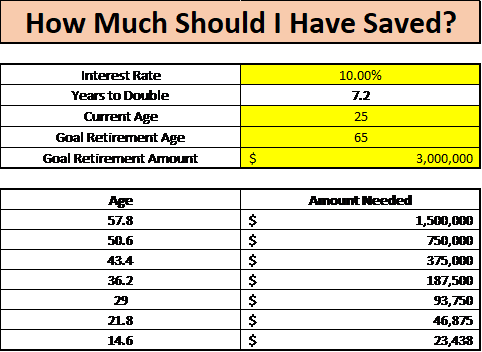

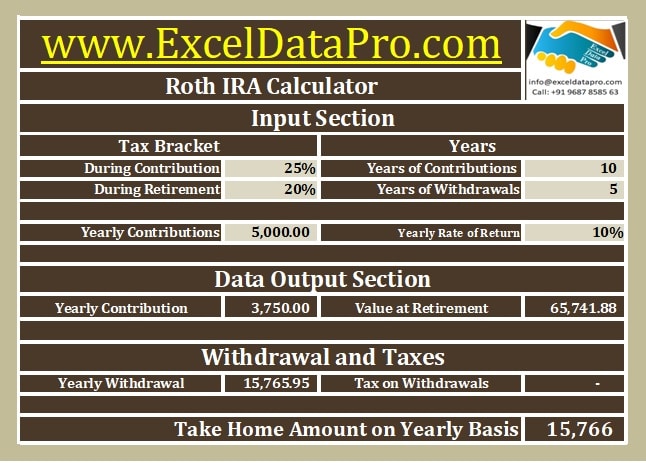

A Convenient Rule Of 72 Calculator To Help Investors Plan For Retirement

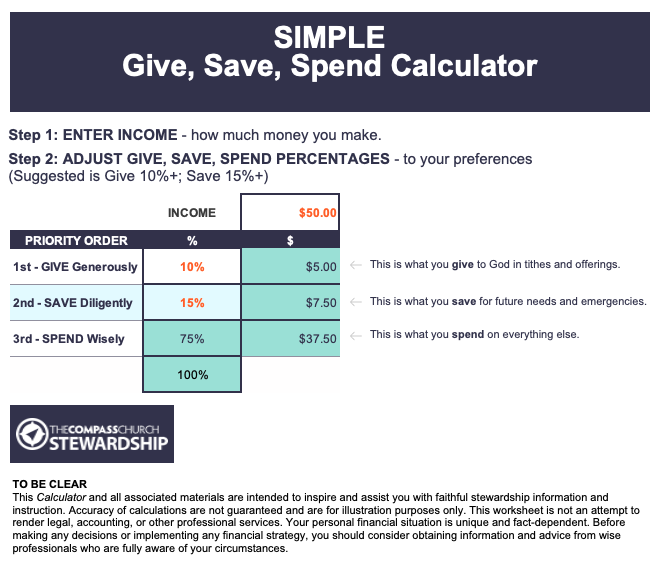

Financial Tools The Compass Church

403b Calculator Making Sure You Have Enough Money To Retire

Download Roth Ira Calculator Excel Template Exceldatapro

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Microsoft Apps

Free 401k Calculator For Excel Calculate Your 401k Savings

Download Roth Ira Calculator Excel Template Exceldatapro

Financial Tips For Couples Infographic Creditkarma Com Financial Tips Infographic Finance

A Convenient Rule Of 72 Calculator To Help Investors Plan For Retirement

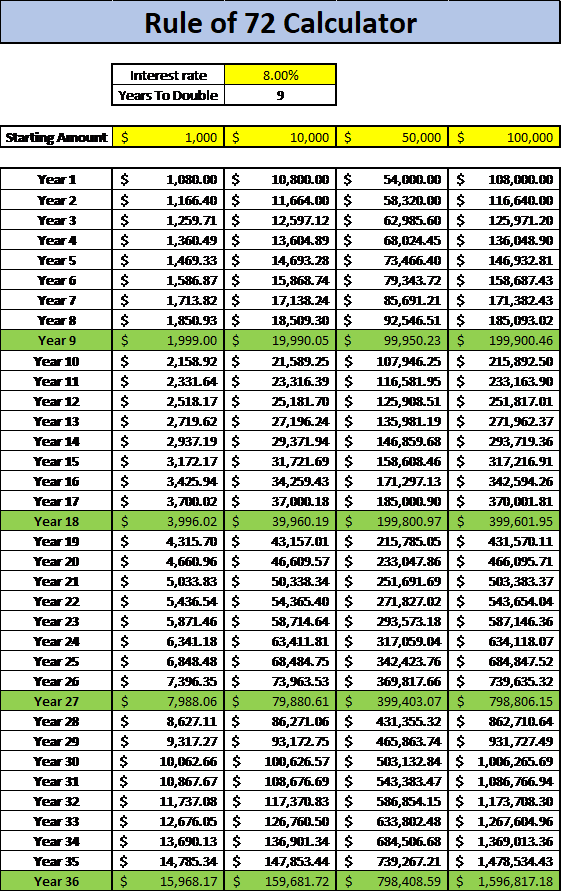

Financial Calculators Service2client S Website Tools

Download Roth Ira Calculator Excel Template Exceldatapro

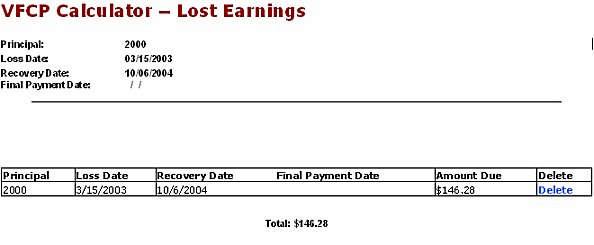

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor